How long has Sub70 owner Jason Hiland been selling golf gear online? Well, if you were alive, you were either doing the Macarena, playing with your new Tickle Me Elmo, watching Season Three of Friends, or learning the names of the first 50 Pokemon.

The worldwide web hosted fewer than 100,000 websites in 1996, and Hiland’s value-priced component/clone company Diamond Tour Golf was one of them.

No one – not even 12-year-old Mark Zuckerberg – could have envisioned the bold, new world of e-Commerce or direct-to-consumer (DTC) golf equipment we have today. And there’s no way college freshman Tom Brady would believe that someday, with just a few keystrokes, he could order – and pay for – a full set of custom-made golf clubs with his dial-up connection and AOL account.

But here we are in 2020, and DTC is the new business model for the new decade. It’s a model that gives you more choices and better pricing, but it’s also a minefield. Most OEMs sell their gear online, directly to you, but only a small handful use DTC as their primary path to market and its unique selling proposition.

Can smaller companies survive the minefield? It’s certainly no easy undertaking, as it requires you to buy clubs you’ve never actually seen from a company you may have never heard of. Hiland’s Sub70 is trying to navigate its way through that minefield to viability.

Mail Order Birdies?

Direct-to-consumer most certainly isn’t a new idea. When I was a lad, we called it mail-order. You’d see something in the Sears Catalog, Boy’s Life, or Popular Mechanics and send away for it. After six to eight weeks of breathless anticipation, it would show up at your door. Today, we’re pissed if we don’t get our Amazon Prime delivery the next day.

The worldwide web has changed the way we live, work, and interact with each other. It’s also changing the way we buy things, making companies like Ben Hogan, Sub70, and others possible.

“More people are using direct-to-consumer brands in the rest of their lives,” says Hiland. “So this isn’t as crazy of a jump as it might have been five years ago.”

There’s plenty of upside to DTC. More choices and better pricing no longer limit you to the handful of OEMs on retailers’ shelves. And since many of these companies are small, you get to deal directly with the owners.

The downside? Well, too many choices can be confusing, compounding the risk of dealing with the unknown. If you don’t like the DTC balls you just bought, you’re out 30 bucks at worst. Golf clubs, however, are bigger ticket items and, therefore, a much bigger risk. Social media, with all its inherent nonsense, has helped lower entry barriers for DTC brands. Every OEM uses social media – some better than others – but for DTC brands, social media is the great equalizer, giving them what amounts to free access to you.

“Without social media, this would be impossible,” says Hiland. “From a customer service standpoint to getting our message out there without having to spend tens of thousands of dollars month? This company could not have existed ten years ago. There’s no doubt in my mind.”

Hogan stumbled upon the DTC model almost by accident. It used social media and its email list to liquidate inventory after bankruptcy. The response showed DTC to be a viable business model.

Hiland, on the other hand, has been selling online for 25 years with Diamond Tour Golf, and for 12 years with Hurricane Golf. The DTC thing wasn’t all that big of a leap, but selling a new brand of golf clubs to a consumer base that is, to put it kindly, set in its ways?

Yeah, that’s a leap.

The Credibility Conundrum

New ventures are hard, and building credibility is even harder. It’s totally understandable – and justifiable – to be wary of an unknown DTC brand. Sending your credit card info into cyberspace for a set of clubs you’ve never seen from a company you’ve never heard of might seem downright foolhardy.

“It’s uncharted territory. It’s a new paradigm,” he says. “You’re trying to tell somebody they don’t have to pay price X for this, they can get something just as good for price Y. Here’s why it’s more efficient, and here’s why it’s better to have everything custom-built.”

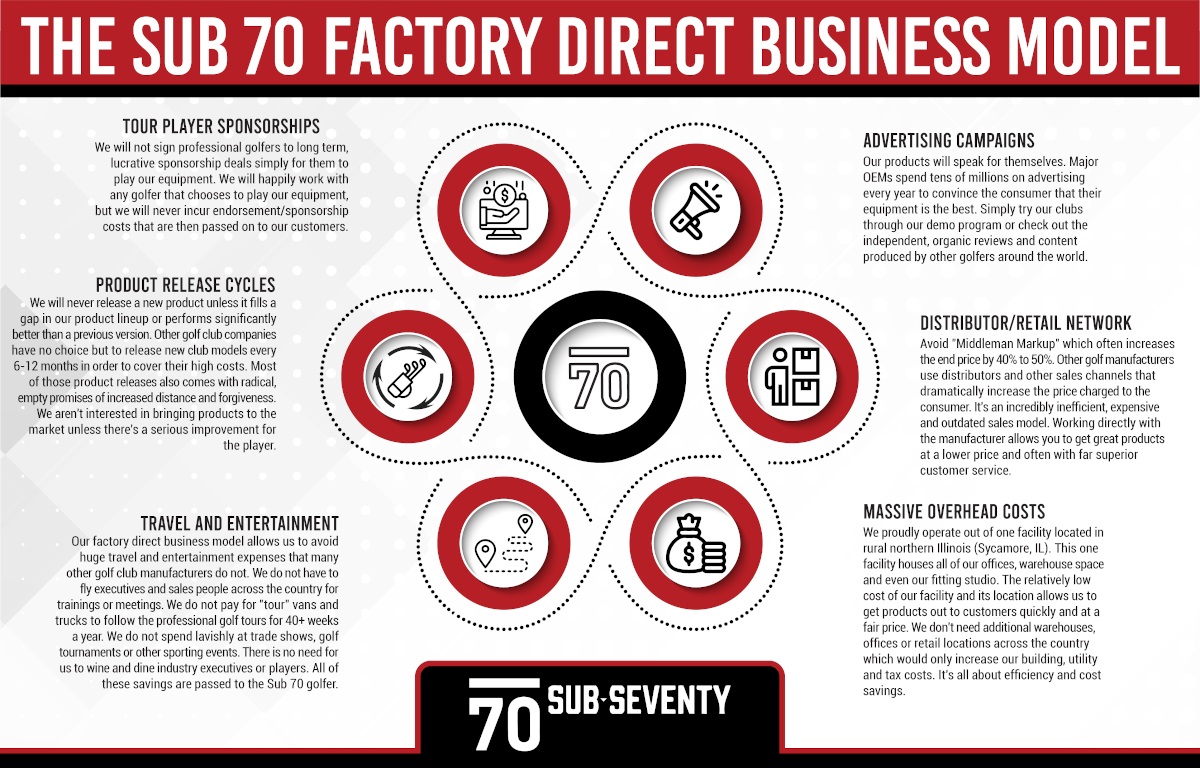

The value proposition for Sub70, Hogan, and others is premium equipment at a substantially lower price. Since there’s no middleman, no field sales team, no TV and print ad campaigns, and minimal-to-non-existent Tour presence, you pocket the difference. Therein lies the DTC conundrum: if the price sounds too good to be true, it probably is.

Hiland admits he thought it would be harder to explain the apparent unicorn of low price, high quality, and custom-built delivery to customers than it turned out to be.

“From talking to customers every day, I attribute it to two things,” he says. “First is people are using the direct to consumer model online for other stuff, so it’s not a crazy leap for early adopters as it might have been five years ago. And second, the third-party reviews we’ve had have helped answer some of those questions.”

While certainly not the top-performing brand in MyGolfSpy’s Most Wanted testing last year, Sub70 performed well enough. If yards per dollar is your decision-making matrix, you’ll find Sub70 a solid value.

“If you Google ‘Review Sub70’ or ‘Sub70 golf reviews,’ you’ll find a lot of positive reviews. That really helped. If we didn’t have that, I don’t think we would be as far along in the process of getting our message out there as we are for a small, one-year-old company.”

And since timing is everything, Sub70 entered the market just as the big OEMs cracked the $500 barrier for drivers and the $1200 barrier for irons.

“The early adopters were like, ‘I read the review, I like your story,’” says Hiland. “They’d say ‘you seem honest, you have a 60-day guaranty, and I’m having a hard time justifying to the family why I’m spending twelve to fifteen-hundred bucks when I can do it for $599.’”

Small is Beautiful

Trying to out-Callaway Callaway or out-TaylorMade TaylorMade is, as a business strategy, extremely stupid if you don’t have Callaway or TaylorMade money. The DTC model banks on brand-weary golfers who are tired of what they perceive as marketing bullshit. It’s for golfers who believe they can get virtually the same performance for a lot less money, and who are ballsy enough to make the leap of faith and plunk down cash for the relative unknown. The fact they’re dealing with a small company is a bonus.

“I’m trying to have individual relationships with my customers,” says Hiland. “My phone number is out there everywhere. I want it to be a unique experience where they can talk to the owner and where we can make sure the customer is taken care of. If it’s not perfect, if it’s not exactly how you think it should be, you can call me personally.”

“It would drive me nuts if I knew somebody had something they weren’t satisfied with. It would literally drive me crazy.”

That approach is becoming common among the small upstart brands in virtually any industry. It’s a point of differentiation and appeals to the buyer who feels lost or alienated in the modern marketing machine. DTC offers an alternative.

“I think there’s this yearning for authenticity and smallness and craftsmanship,” says Hiland. “It’s not just in golf. Lots of people would rather go to a local restaurant than a chain. Small branded beers are doing great.”

The thing that ties all this together, of course, is the internet.

“Mark Calcavecchia reached out to me last year to build him some Pro Fairway woods,” says Hiland. “We built him a 3- and a 5-wood, and when he put on social media he was going to game them – and we’re not paying him – our phones just blew up. You talk about social media impact, that was huge for us.”

A brand like Sub70 wouldn’t even have had access to a Calcavecchia five years ago, but as the song says, your old road is rapidly aging. The new paradigm is surely shaking windows and rattling walls, but the times might not a-change if the product isn’t any good.

The China Syndrome

As with virtually every other club head in golf, Sub70’s are made in China. Hiland admits he’s no engineer and has no in-house R&D. Product development, he says, is a team effort with his Asian suppliers.

“We’ll come up with a general idea of what we want, and then we rely on them to help us design the guts of it,” he says. “We utilize their engineers to help develop the clubs. I come in and try to make it look sexy, but for lack of a better word, it’s like having on-demand engineers. There’s no way I’m doing that all on my own.”

Hiland has a 25-year relationship with his factories, and he owns the designs and molds they jointly develop.

“I don’t go outside my core group,” he says. “They know I’m going to pay the bill, and I’m willing to pay the price for quality.”

A common narrative in the golf business is the bigger OEMs – the ones that do their own R&D – tend to be a step or two ahead of the challenger brands when it comes to technology. It’s a narrative that may, in fact, be perpetuated by the big OEMs and their fans.

“We’re not trying to copy what others are doing,” says Hiland. “We’re trying to come up with the best product we can. If you put our 699 iron up against other players distance irons, is there a performance difference, or does it hold par with pretty much everything else?”

Last year’s Most Wanted indicates there isn’t, and it does. The 699 finished solidly in 6th place overall, ahead of such stalwarts as the Callaway Apex and Rogue Pro, the Titleist AP3, and the PING i500. Top of the line performance? Debatable. A performance-per-dollar value? It’s hard to argue otherwise.

Cycles and Such

Can your brain wrap itself around the notion that an unknown set of irons priced at less than $500 can be on par with, or in some cases outperform, big-name clubs that cost as much as $1,000 more? How about a $249 driver? As riled as we get over mainstream OEM pricing, the idea of equal or better performance at a lower price simply does not compute.

“Every piece of equipment from every major brand is world-class,” admits Hiland. “You really can’t tell the difference. You could take every major driver and put them side-by-side, they’re pretty indistinguishable when it comes to ball speed.”

The brands you know – the mainstream brands – are safe choices. You know what you’re getting, and that comfort comes at a premium. The major OEMs are also substantial R&D, sales, and marketing machines. You’re paying for that, too, as well as all the effort that goes into sustaining one- to two-year product cycles. DTC companies, whether it’s by choice or necessity, aren’t slaves to a product release calendar.

“Customers trust me to know I’m not going to BS them,” says Hiland. “None of our products are going to be on a tight life cycle. If I can’t make the 699 have better ball speed or be more accurate or just plain better, I’m not going to lie to people and hope they’ll buy it again when it’s not much different. I can’t do that to my customers.”

In addition to Calcavecchia, you will start seeing Sub70 on the PGA and Korn Ferry tours, and has just signed a deal with Tommy Armour III to play Sub70 on the Champions Tour.

“We’ll be working with Tommy to develop a forged iron,” says Hiland. “He’s now gaming the 639 CB irons, but this will be his signature series club. When it’s ready, we’ll sell it in a wooden box with his logo – very boutique-ish, very niche, but with a Sub70 price.”

Is DTC For You?

Asking Alexa to order your basic household supplies is one thing, but golf clubs? For many, that’s a bridge too far. There’s still a sizable portion of the golf buying world that insists on hitting demo clubs into a screen at a retail outlet first. You can’t do that with DTC, but they do have demo programs that allow you to try a couple of clubs on your own for a couple of weeks. There’s also the whole fitting challenge, something Hogan has addressed by opening up fitters such as Club Champion. Sub70 isn’t there yet, but they do have an online fitting tool and will build clubs to your specs.

The biggest challenge remains comfort. Make a bad decision buying balls DTC and it’s 30 bucks. A full set of clubs, even at attractive DTC pricing, might still run you $700 to $1,000. That’s where your interactions with the DTC company can make a difference.

“We’re just going to send our message of what we do at Sub70 out there and try to be as honest as we can about it,” says Hiland. “Hopefully, the interconnected world on the internet will provide reassurance that this is quality, it’s every bit as good, and it’s custom-made.”

“We try to offer a better value for the customer. We can do it for a much better price because our model is so efficient. It’s not because of the quality of the product; it’s the way we deliver it. We cut a lot of layers out of it.”

The post Sub70 Golf appeared first on MyGolfSpy.